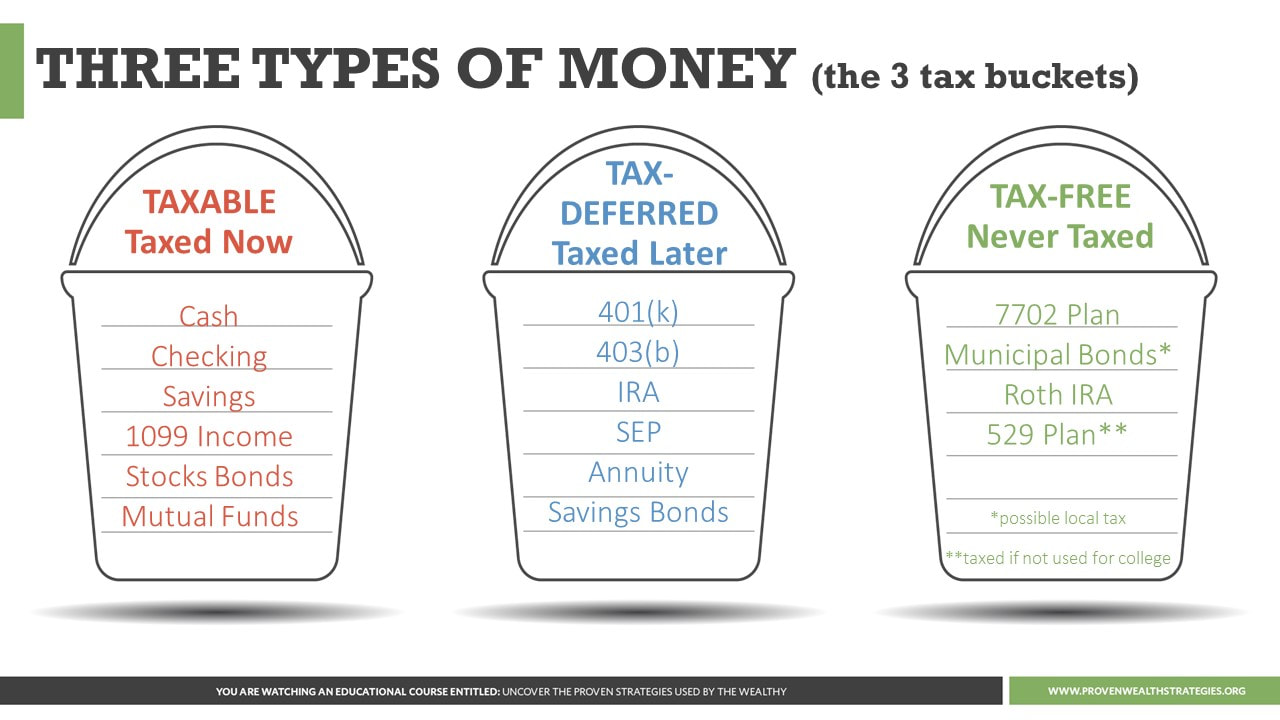

Where does 7702, 403b, 401k, 529, Roth, SEP etc. come from?

These are actually IRS codes and statutes. These codes and statutes basically

determine which of the below buckets your money goes in and how the

accumulation, growth and distribution of your money will be taxed.

These are actually IRS codes and statutes. These codes and statutes basically

determine which of the below buckets your money goes in and how the

accumulation, growth and distribution of your money will be taxed.

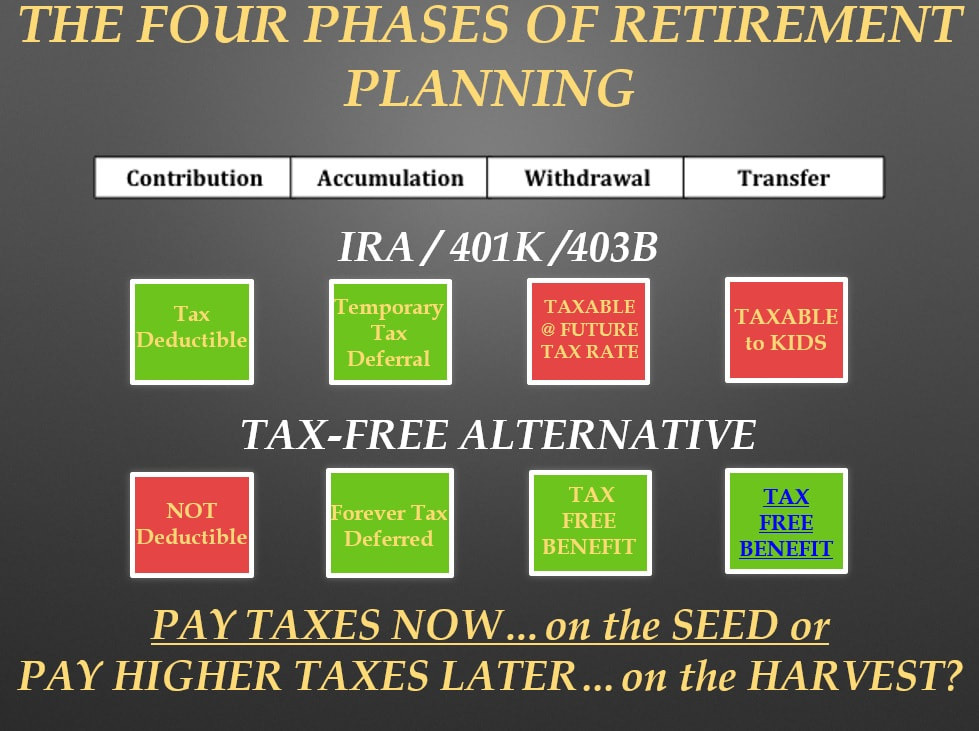

The below chart is a great visual of how retirement money

is treated "tax wise" from the first dollar to after death.

is treated "tax wise" from the first dollar to after death.

1. At the Contribution phase, Qualified plans as in 401k's, 403b's, IRA's, pension plans etc., are always Tax Deductible. (pre-tax)

Tax Free plans as in 7702's and Roth's etc., are Not Tax Deductible. (post-tax)

An easy way to understand this is on pre-tax, your contribution usually comes out of your pay check first, then the rest is taxed.

On post-tax, your contribution usually comes out of your checking or savings account.

2. At the Accumulation phase both are tax deferred which is good because more money is able to compound because neither the principle or gain is taxed.

The huge difference is in pre-tax, the deferral is temporary...the tax man will eventually get his due.

On the other hand, the post-tax plan, is forever tax deferred.

3. The Withdrawal phase is where you can have hundreds of thousands more money to retire on when your withdrawal is TAX FREE. Hence, Retire Early!

For example: if you needed $50,000 a year added to your social security or pension to retire comfortably, in a 25% tax bracket you would need to withdraw $66,667, pay Uncle Sam $16,667, and have $50,000 left over.

With Tax Free, you just withdraw $50,000.

Hence, your nest egg lasts longer before it is depleted.

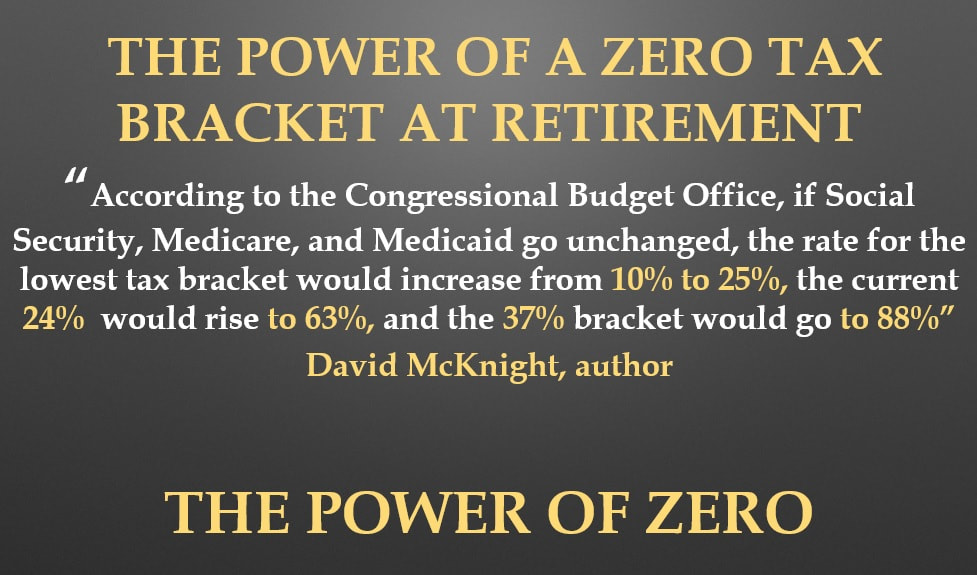

With income taxes being historically low right now, doesn't it make sense to have a portion of your retirement dollars Tax Free?

Tax Free plans as in 7702's and Roth's etc., are Not Tax Deductible. (post-tax)

An easy way to understand this is on pre-tax, your contribution usually comes out of your pay check first, then the rest is taxed.

On post-tax, your contribution usually comes out of your checking or savings account.

2. At the Accumulation phase both are tax deferred which is good because more money is able to compound because neither the principle or gain is taxed.

The huge difference is in pre-tax, the deferral is temporary...the tax man will eventually get his due.

On the other hand, the post-tax plan, is forever tax deferred.

3. The Withdrawal phase is where you can have hundreds of thousands more money to retire on when your withdrawal is TAX FREE. Hence, Retire Early!

For example: if you needed $50,000 a year added to your social security or pension to retire comfortably, in a 25% tax bracket you would need to withdraw $66,667, pay Uncle Sam $16,667, and have $50,000 left over.

With Tax Free, you just withdraw $50,000.

Hence, your nest egg lasts longer before it is depleted.

With income taxes being historically low right now, doesn't it make sense to have a portion of your retirement dollars Tax Free?

To schedule an appointment for a Zoom meeting and receive a complementary copy of David's new book, The Power of Zero, fill out form below. Please enter your cell phone number and best day and time to call in the Comment section.